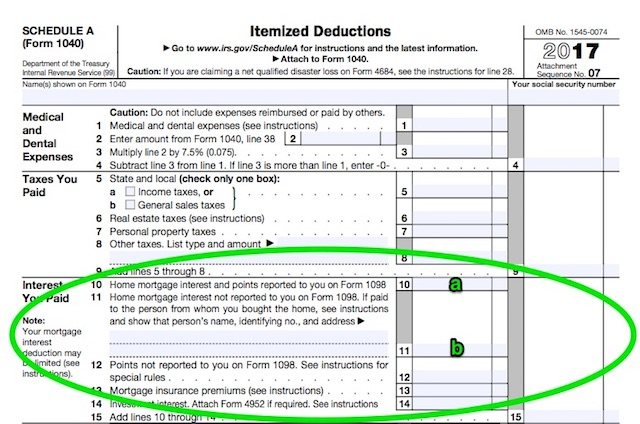

You cannot deduct anything above this amount. The limit is $10,000 - $5,000 if married filing separately. Your deduction for state and local income, sales, and property taxes is limited to a combined total deduction. If you keep all your receipts, you can deduct actual sales and use tax you paid during the tax year. If you did not keep receipts, the IRS provides an online Sales Tax Deduction Calculator to determine the amount of optional general sales tax you can claim, or you can use the Optional State Sales Tax Tables. (This does not apply if you take the standard deduction.) If you qualify to itemize your deductions on Form 1040, Schedule A, you can take this deduction. You may continue to itemize and deduct sales tax on your 2018 federal income tax returns. Businesses that make retail sales or provide retail services may be required to collect and submit retail sales tax (see Marketplace Fairness – Leveling the Playing Field).įederal sales tax deduction for tax year 2018 The business’s gross receipts determine the amount of tax they are required to pay. However, people or businesses that engage in business in Washington are subject to business and occupation (B&O) and/or public utility tax. Washington state does not have a personal or corporate income tax.

0 kommentar(er)

0 kommentar(er)